Grow your Investments

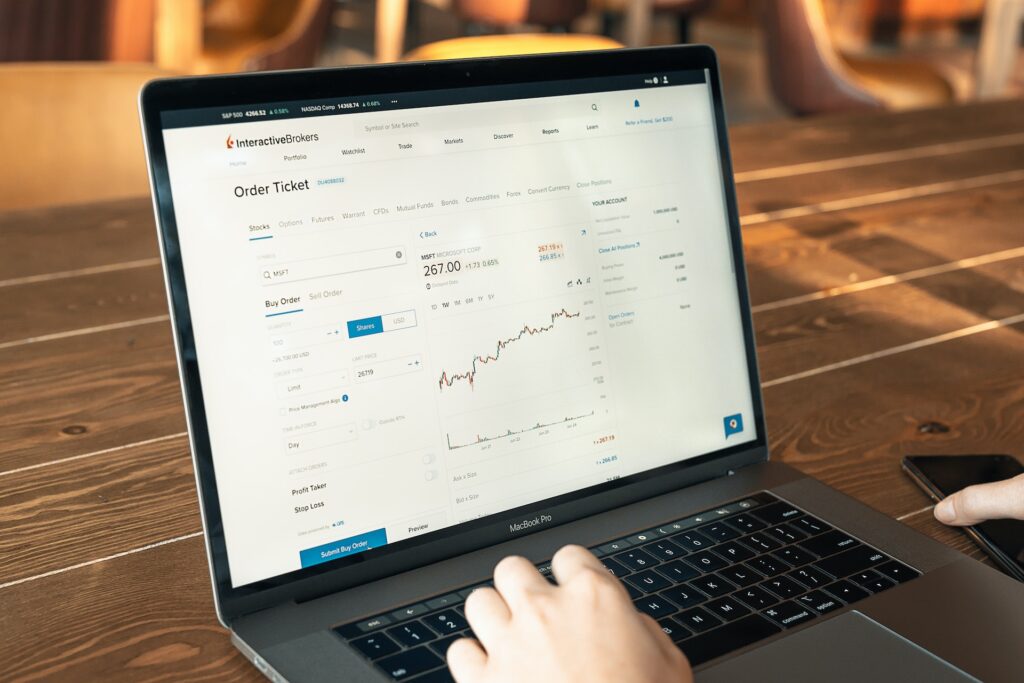

About ACE Research & Advisory

At ACE Research & Adivosry, we specialize in assisting you in identifying sound investment opportunities. As SEBI-registered and research-focused advisors, we are dedicated to providing our clients with research to recommend the investment opportunities of exceptional value.

Our vision at ACE Research & Advisory is to ascend as an industry leader through the delivery of high-quality services and the promotion of innovation.

We firmly believe that everyone deserves top-notch guidance when it comes to managing their investments. Our innovative and forward-thinking approach empowers individuals to explore investment strategies and opportunities. We are passionate about helping you pinpoint the most suitable investment opportunities for your financial goals and risk appetite.

Financial Planning and Wealth Management

When it comes to financial planning, there are a few key things to keep in mind. First, you need to have a clear understanding of your current financial situation. This includes knowing how much money you have coming in and going out each month. You also need to be aware of any debts or other obligations that you may have.

Once you have a good understanding of your current financial situation, you can start thinking about your long-term goals.

- What do you want to achieve financially?

- Do you want to retire early?

- Do you want to buy a home?

- Or maybe you want to start your own business.

Refer to the section below to understand a bit more about different Financial Plans

Retirement Plans

There are different types of retirement plans, including pension plans, annuities etc. Each type of plan has its own benefits and drawbacks, so it’s important to do your research before deciding which one is right for you.

Investment Plans

If you’re looking to grow your wealth, an investment plan may be the right choice for you. Investment plans can include stocks, bonds, mutual funds, and more. Again, it’s important to do your research before making any decisions.

Insurance Plans

Insurance can help protect you and your family in case of an unexpected event, like an accident or illness. There are many different types of insurance policies available, so make sure to find one that meets your needs.

Estate Planning

Estate planning is important for everyone, regardless of their age or assets. An estate plan can help ensure that your assets are distributed according to your wishes in the event of your death.

Tax Planning

Tax planning is a critical part of financial planning for individuals and businesses. A good tax plan can help you save money on your taxes and maximise your financial goals.

The different types of wealth management strategies

Investment & Portfolio Management

Potential of Derivative Instruments

To generate consistent, risk-adjusted returns for investors over the short or long term, there are diverse trading strategies in the derivatives market with the objective of earning profits by taking non-directional positions in the derivative securities. And the same is possible by using the existing invested equity and mutual fund holdings where an Investor can take a margin from NSE and trade in derivatives. Refer below some of the benefits of the same.

Investors seeking superior risk-adjusted returns by leveraging existing investments

Investors looking to earn consistent returns in all market scenarios

Suitable for investors who want to diversify the portfolio to low risk investment which matches the mid-risk return

Investor who wants to maximise the utilisation of funds/investment with anytime liquidity available

How an investor can take a benefit of the derivative instruments, refer below !

How an Investor can take steps to get benefits of the derivative instruments

Make the best combination of assets of risk-free return and leverage these investments to trade in derivative Instuments.

Use the combination of existing investments and get a margin to trade in derivative instruments

This has the potential of growing investors wealth without exposing to the market at large

Funds will be in Liquid form and available when needed subject to the norms of regulators and will be transparent on day 1 of investment (like T+1, T+2 days in processing the fund back to the bank account).

Benefits Of Above

Ensuring the maximum utilisations of the funds

Money stays in your Demat accounts and it’s liquid to use anytime it’s needed

Daily email from your brokers on fund position, hence no hassle to reach out to the fund houses multiple times a day to get the fund position

Ensuring that no hidden charges are imposed by brokers by periodically reviewing their ledgers

Use of existing equity, MFs, or other securities as margin and make money on it additionally

FDs + MFs +Equity + Other Securities, be it anything the above-mentioned steps will ensure to utilise all the combinations of securities and keep your portfolio diversified

Taxation of Various Schemes

Fund type | Short-term capital gains | Long-term capital gains |

Equity / Equity Oriented Mutual Funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

Debt Funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

Hybrid equity-oriented funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

Hybrid debt-oriented funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

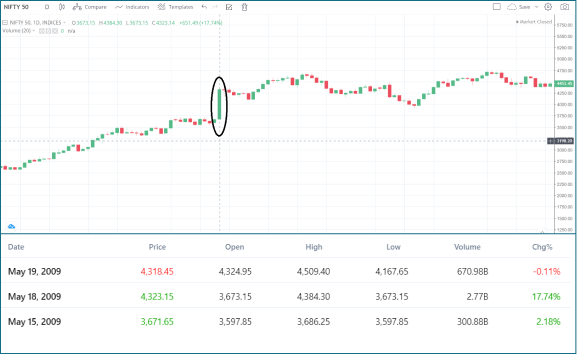

An Overview of Indian Derivatives Markets

ACE Tools

NEWS

-

Buy HDFC Bank; target of Rs 1,850: ICICI Securities

Source: Moneycontrol Published on 2024-04-23

-

Buy Tejas Networks; target of Rs 1100: Emkay Global Financial

Source: Moneycontrol Published on 2024-04-23

-

Buy Bajaj Finance; target of Rs 9000: Emkay Global Financial

Source: Moneycontrol Published on 2024-04-23

-

Buy Bajaj Finance; target of Rs 9000: Emkay Global Financial

Source: Moneycontrol Published on 2024-04-23

-

Reduce Persistent Systems; target of Rs 3700: Emkay Global Financial

Source: Moneycontrol Published on 2024-04-23